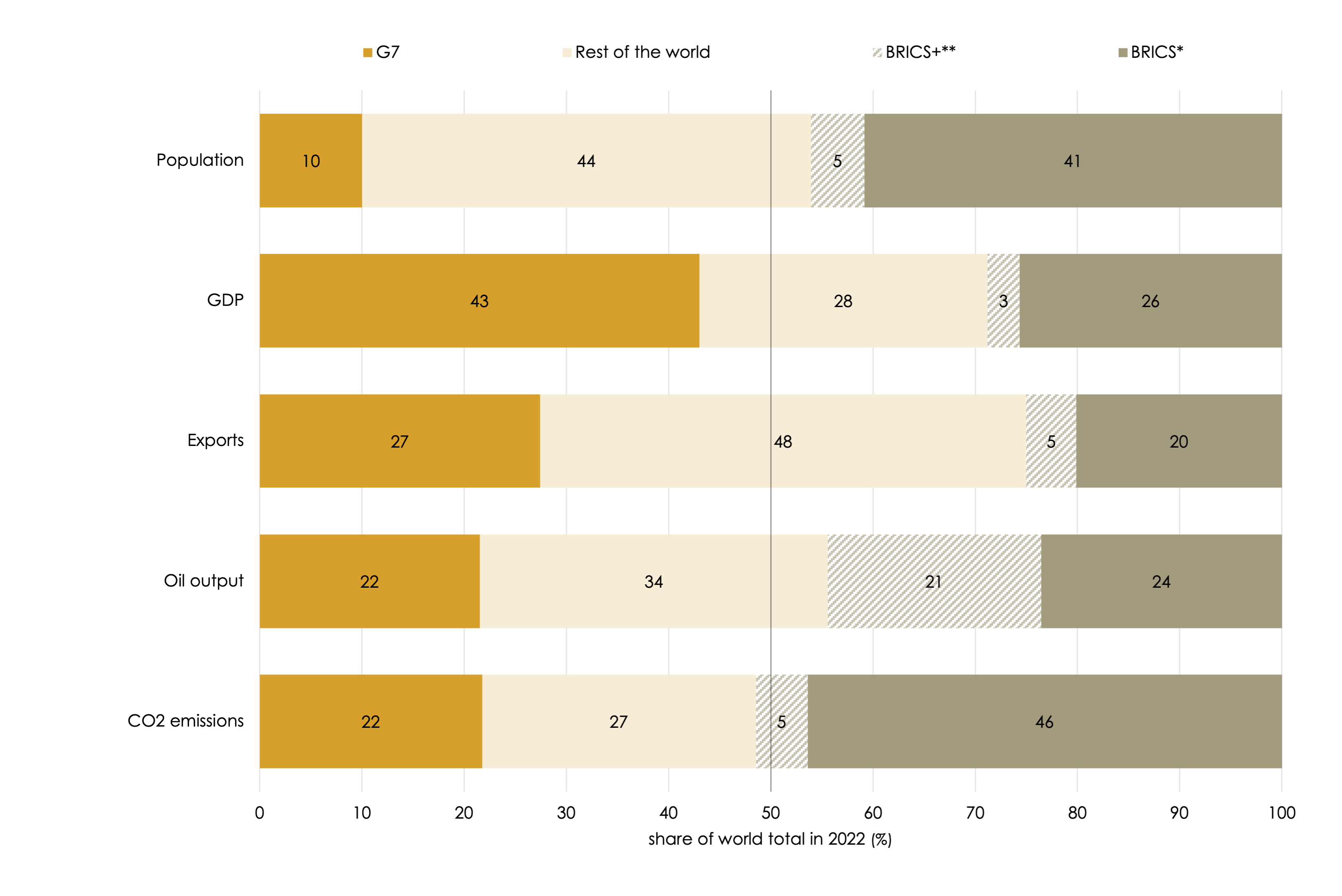

We are facing a more complex world. Economic crises have intensified recently, and the global economy is facing major transformations, the first being the geopolitical changes and ongoing conflicts, which are altering the global economic order. A significant example of these changes is the recent announcement by the BRICS -a group composed of Brazil, Russia, India, China, and South Africa- of their proposal for enlargement from 2024 to include Argentina, Saudi Arabia, the United Arab Emirates, Egypt, Ethiopia, and Iran. The potential consolidation of this group of countries will have significant implications in the medium term, as evidenced by their weight in terms of population and oil production (see figure 1); it is also noteworthy that some of them are geopolitical actors in the current Middle East conflict.

Furthermore, other notable transformations occurring in the global economy include the response to climate change and the energy transition, the digital revolution, the increasing role of the State in the economy and aging of the population.

FIGURE 1. PERCENTAGE OF THE WORLD TOTAL REPRESENTED BY THE G7, THE BRICS AND THE PROPOSED NEW MEMBERS OF THE BRICS IN A SELECTION OF VARIABLES FOR 2022.

(*) Current BRICS members: Brazil, Russia, India, China, South Africa. (**) Proposed BRICS+ members: Argentina, Saudi Arabia, Egypt, Ethiopia, Iran, and United Arab Emirates

(*) Current BRICS members: Brazil, Russia, India, China, South Africa. (**) Proposed BRICS+ members: Argentina, Saudi Arabia, Egypt, Ethiopia, Iran, and United Arab Emirates

Source: World Bank, Equipo Económico (Ee).

In addition, the latest economic crisis still has two clear consequences for a global economy amid a slowdown: the persistence of inflation in developed economies due to existing supply-side imbalances and the sharp increase in public debt. To address these issues from the monetary policy perspective, interest rates will remain higher-for-longer. While from the fiscal policy perspective, debate arises about the necessary fiscal consolidation to recover room to maneuver in the face of future shocks and the incapacity of governments to reduce the current high levels of public debt.

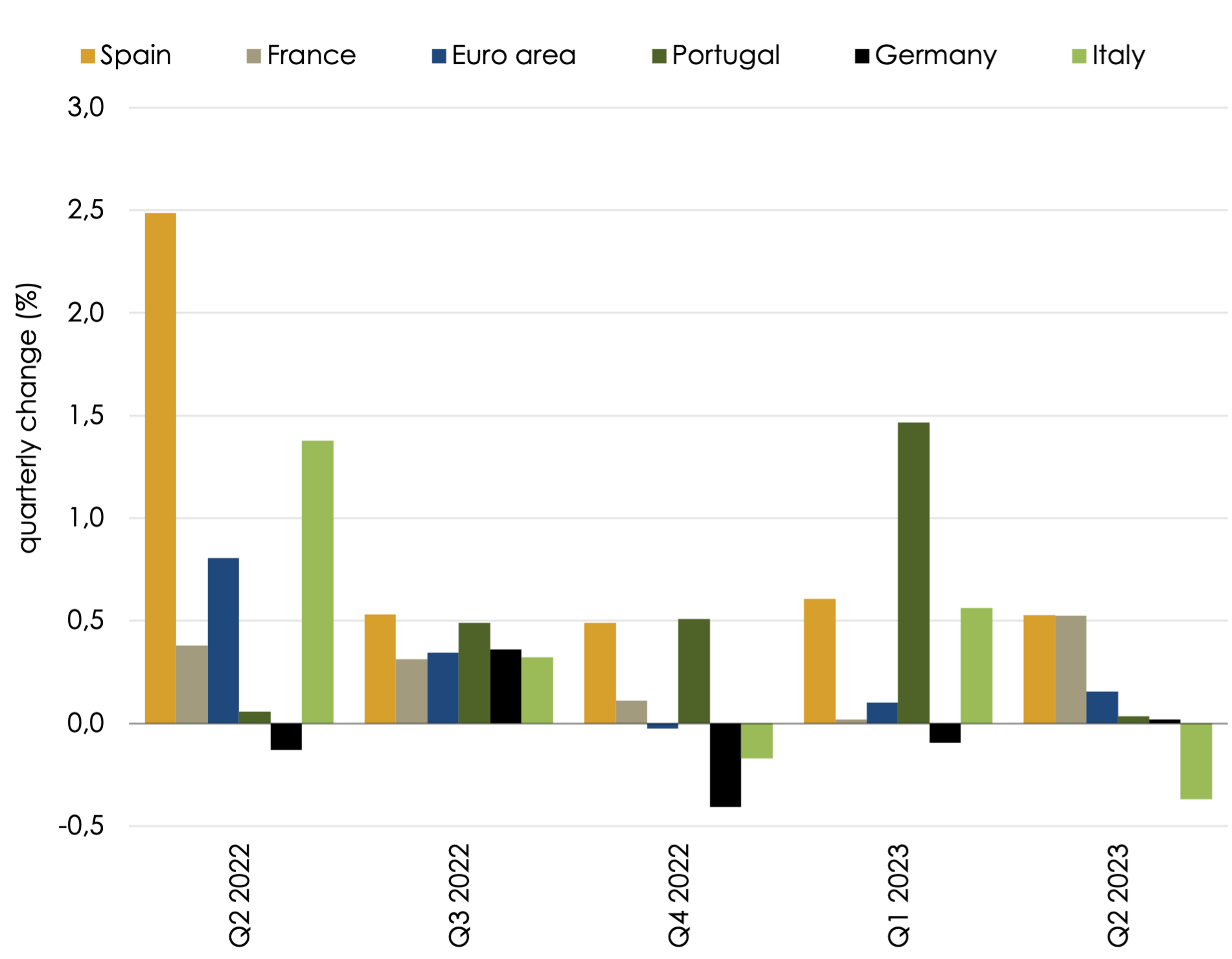

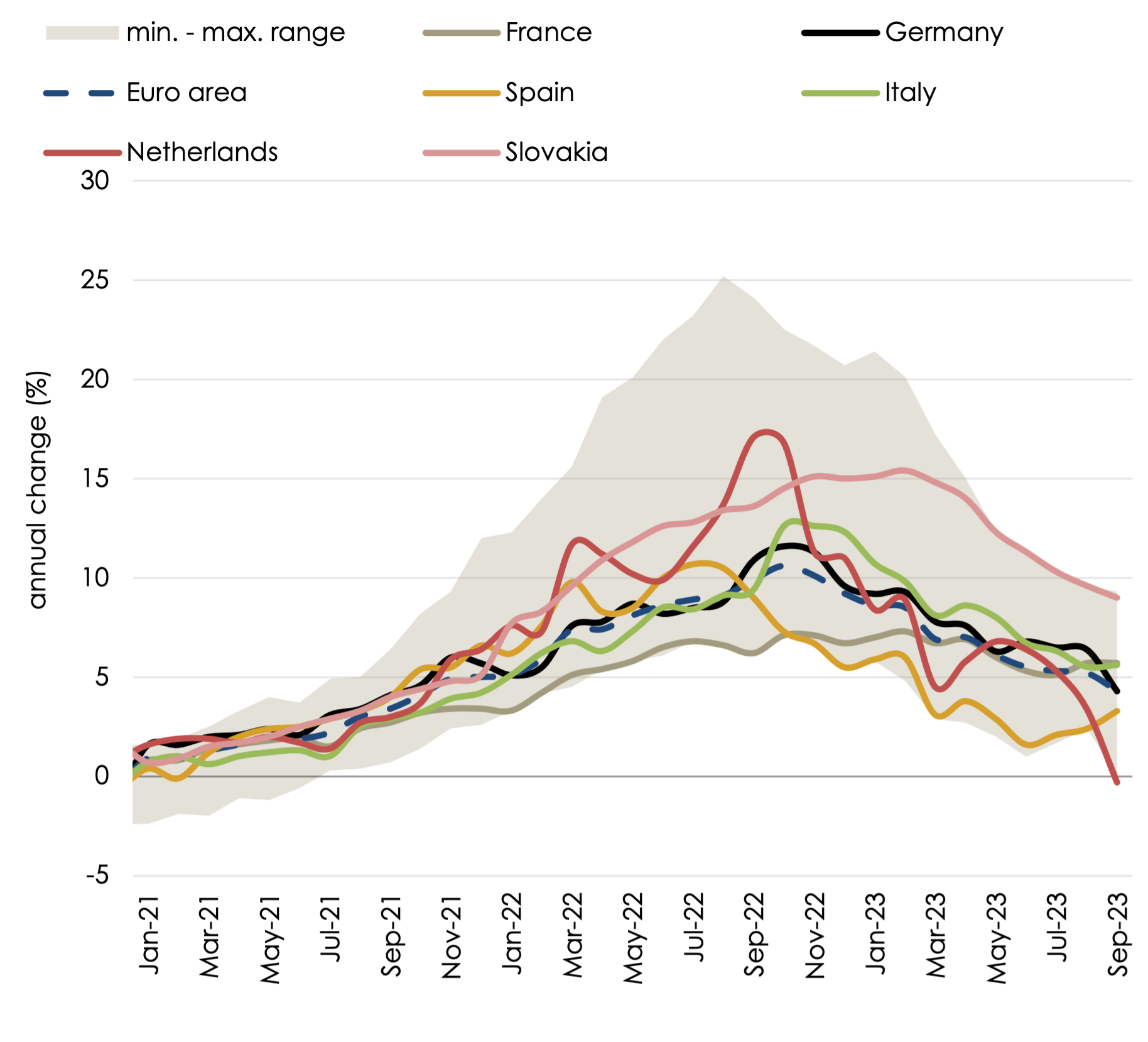

Meanwhile, the eurozone is in a clear scenario of stagnation, but with a strong heterogeneity by countries, as shown in figures 2 and 3. The case of Germany stands out for being one of the hardest hit EU countries since the beginning of the Ukraine war, especially its industrial sector. On the other hand, official interest rates hikes are being passed on through a sharp increase in financing conditions across the euro area. However, there is major uncertainty about the impact of monetary policy tightening on economic activity. In this context, fiscal policy and the reform of EU fiscal rules takes on greater importance. European Parliament and the Council have yet to reach an agreement on this issue to complete the legislative work by the end of 2023. Finally, and partly as a reaction to the complex international situation, the EU has an ambitious agenda, ranging from the search for energy autonomy to the enlargement towards EU30+.

FIGURE 2 AND 3. QUARTERLY GDP GROWTH (LEFT) AND ANNUAL HARMONIZED CONSUMER PRICE INDEX GROWTH (RIGHT).

Source: Eurostat, Equipo Económico (Ee).

The Spanish economy is now growing clearly above the European average, but it is also slowing down. Moreover, Spain was the last eurozone country to recover its pre-pandemic GDP, achieving this milestone in the third quarter of 2022. It was mainly driven by the services sector, while industry, construction and agriculture have not yet recovered. On the demand side, private consumption has also failed to recover. However, the sectoral composition is now benefiting the Spanish economy in comparative terms. Thus, the foreign sector is now boosting the country’s economy, with tourism playing a prominent role, having fully recovered from the pandemic, and with spending per tourist having increased considerably in 2023 compared to 2019. In this context, the labor market is proving to be resilient, but important imbalances remain, as evidenced by the fact that it still has the highest EU’s unemployment rate. On the other hand, the rise in interest rates to control inflation is having a clear impact on demand in the real estate sector; however, housing prices have continued to grow.

After a better-than-expected first semester, most recent indicators point to the deceleration of activity in the third quarter of 2023. Also considering the recent update of official Spanish GDP figures, at Equipo Económico (Ee), we forecast a GDP growth rate of 2.5% in 2023, which is above our January forecast of 2.1% but well below the 5.8% growth registered in 2022 (see table 1). For 2024, we estimate a GDP growth of 1.8%, only slightly above potential growth, considering an expected worse contribution of the foreign sector, and despite the gradually more important role that Next Generation EU funds will play in the investment. Moreover, we forecast average annual CPI growth at 3.7% in 2023, followed by a further decrease to 3.5% in 2024, so that inflationary pressures will persist. Meanwhile, renewed disruptions in international energy markets remain an upside risk.

TABLE 1. EQUIPO ECONÓMICO (Ee) FORECASTS FOR THE MAIN MACROMAGNITUDES OF THE SPANISH ECONOMY IN 2023 AND 2024.

Source: INE, Bank of Spain, Equipo Económico (Ee). (*) Equipo Económico (Ee) forecast (Oct.-2023).

From the Public Administration perspective, Spanish public debt continues to grow in a context of increased State intervention and lack of fiscal discipline. Furthermore, in a context of political instability, combined with an acting government, and given the large structural spending of recent years, we estimate that the public deficit will be close to 4% of GDP in 2023. A softening of the deficit is expected in 2024, due to the return of European fiscal rules.

Fostering sustained growth in the very challenging current scenario requires mutually consistent monetary and fiscal policy, as well as undertaking ambitious supply-side structural reforms. However, its implementation in Spain is improbable in the short term, given the obvious difficulty of having a government committed to the necessary structural reforms on a sufficiently consensual basis. In the international context of profound transformations, the Spanish economy is at risk of stagnation, which would entail high welfare costs in the medium and long term.

Jorge Vindel González. Economic Analyst.

Raquel Lorenzo Alonso. Economic Analyst.

Juan Babío Segura. Intern Economic Analyst.